APRA reveals vision for private health insurance

Background

[On July 1 2015 APRA replaced the Private Health Insurance Administration Council (PHIAC) as the regulator for private health insurers. This is in line with the general trend to have the one unified prudential regulator across the whole financial services sector.]

It’s now two and a half years since APRA assumed responsibility for regulating private health insurance in Australia. APRA is charged with safeguarding the financial interests of all Australian private health insurance policyholders, along with bank, credit union and building society account holders, general and life insurance policyholders and most superannuation fund members. Our mission is to ensure the institutions we regulate — including health insurers — manage their businesses and finances in a sensible, or prudent, manner, and can therefore fulfil the promises they make to their customers.

[APRA is the “prudential” regulator. Its obligations relate to the continuing financial viability of the entities it supervises. “Consumer affairs” in the broader sense is the responsibility of the ACCC and ASIC.]

Since taking responsibility for the oversight of health insurance in July 2015, APRA has worked to expand our understanding of the industry, and the nature and scale of the challenges it faces. We also began an intensive review of the state of the private health insurance sector to gauge how well-placed it was to cope with current and predicted demands.

So looking at private health insurance in February 2018, I’d like to outline now what we see as the key markers of the health and sustainability of the industry.

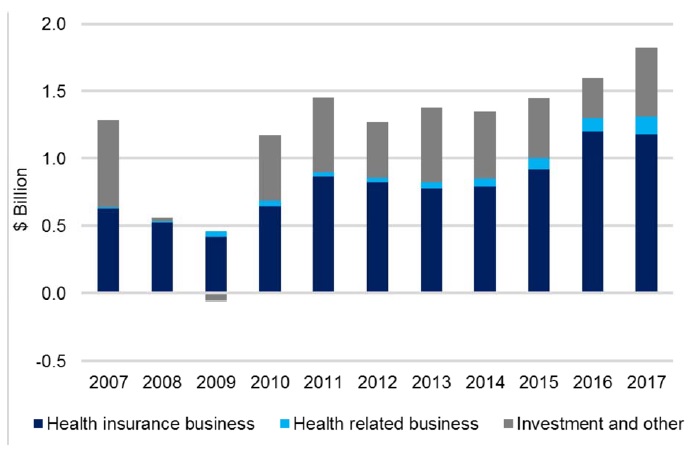

Figure 1: Sources of industry profit (year ending June)

Industry profit is in good health. After two tough years during the GFC, overall private health insurance profit bounced back in the year to June 2010, and hasn’t faltered since. Investment income is growing despite the challenges of the low interest rate environment, while profits from health-related business are also rising as health funds complement their insurance activities to better service their existing members and compete for new ones.

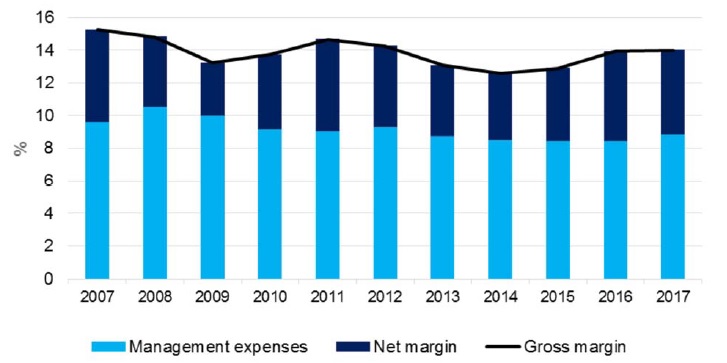

Figure 2: Industry margins (as at 30 June)

Profit margins are also steady. Despite a small degree of fluctuation, the industry has consistently maintained a healthy level of profitability over the past decade.

Consider

Capital buffers

The industry is soundly capitalised relative to APRA’s minimum requirements, at a level on par with both the life and general sectors. Consistent with their legal obligations, private health insurers operate with prudent capital buffers incorporating their own binding internal targets. These buffers act as prudential safeguards, minimising the chances of insurers breaching regulatory minimums or their own capital needs.

As stated in our submission to the recent Senate inquiry on affordability and value, APRA doesn’t believe capital levels in private health insurance are too high or should be reduced. Likewise, the industry’s solvency level is comfortably above our minimum requirements. At face value, then, the PHI industry appears firmly resilient. But we also see data that gives us cause for concern.

Underlying health problems

I’d like to state clearly that APRA has no current prudential concerns about the state of Australia’s private health insurance industry. That was true in 2015 and it’s true now in 2018, but I’m not sure how much longer APRA will hold that view.

Cybersecurity, and trust and reputation have been on APRA’s radar for some time as significant risks facing the private health insurance industry. More recently, we’ve become increasingly concerned by the risks posed by two further issues: affordability and consumer behaviour; and policy and regulatory changes.

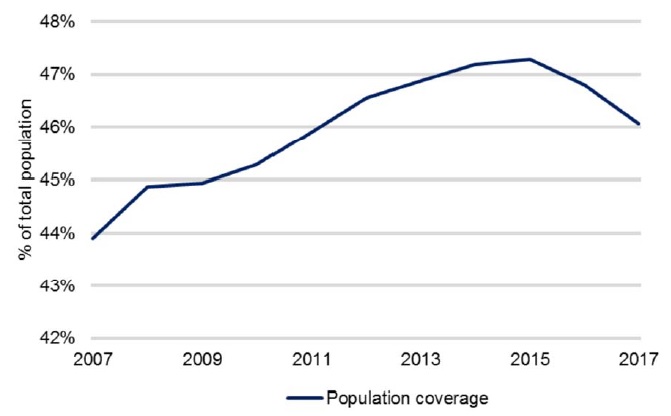

Figure 3: Population coverage for hospital treatment (as at 30 June)

Source: Australian Bureau of Statistics, APRA/PHIAC.

After growing steadily for the past decade, the percentage of the population covered by insurance for hospital treatment has declined over the past two years to 46%. But those choosing to leave the private system and rely on Medicare aren’t equally distributed across the population; they are typically the younger and healthier policyholders needed in a community-rated system to subsidise the old and sick. Remaining policyholders must carry an increasing share of these costs through higher premiums, adding further pressure to their household budgets and raising the risk of them also leaving the system.

What concerns APRA is we see no indication that an improvement in affordability is imminent. In fact, the data points to the trend worsening.

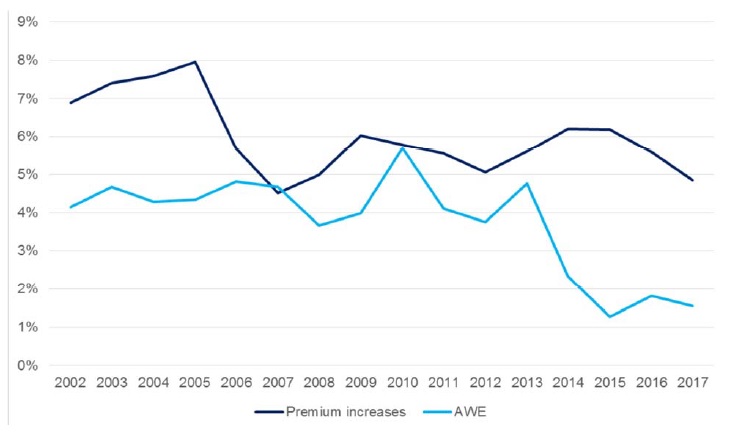

Figure 4: Increases in premiums and AWE

On just two brief occasions over the past 15 years has average wage inflation exceeded average health insurance premium increases, and only if rate protection is taken into account. Premium rises may have tailed noticeably down since 2015, but average premium growth remains significantly higher than wage growth. Looking at the current premium round, the approved premium rises among all 37 health insurers ranged from 2.28 to 8.9% — all higher than full-time average adult weekly earnings at 1.8% (Australian Bureau of Statistics 2017).

Based on the trends, the proportion of the population covered by private health insurance is likely to fall further. This is not necessarily a prudential concern on its own, but it certainly will be if the proportion of younger, healthier policyholders keeps declining, raising costs and forcing premiums higher still, further pushing younger members out of the system. The prospect of a shrinking, ageing and less healthy population of health insurance policyholders raises questions for APRA about the industry’s long-term sustainability.

Growing concern about these trends has prompted an increasingly strong political response that will have consequences for the future structure and management of private health insurers.

The package of reforms (Department of Health 2017) announced by the Federal Government in October specifically seeks to tackle affordability and reverse the exodus of the younger, healthier cohort from the system.

December’s Senate Committee report into the affordability of private health insurance made 19 recommendations (Parliament of Australia 2017), chiefly proposing increased transparency around costs and expenditure. It’s too early to know if these measures will be implemented or what impact they will have. But tellingly, not one submission to the Senate Inquiry expected premiums to fall in the near term.

Did you know?

For our part, APRA is progressing with changes to the prudential framework designed to bolster industry resilience and performance. In August 2016, we released a letter to the industry outlining our proposed private health insurance policy roadmap, identifying three priorities: risk management, governance and capital. Implementing and complying with all these important government and regulatory changes represents a significant challenge to the industry, and we have concerns about the ability of some insurers to deal with the scale and pace of reform.

Although scrutiny of the industry has been especially intense of late, APRA recognises that health insurers have a limited ability to fix the major structural issues that are chiefly driving the affordability dilemma. But that doesn’t mean you are powerless to respond. Beyond individual funds lifting their resilience, the entire industry can raise further awareness of the affordability factors that threaten the sector’s long-term viability and yet are outside its direct control.

While debate about the rising cost of health insurance is both appropriate and legitimate, it’s important the conversation is informed and correctly focused. APRA does not consider industry profits or capital levels to be the primary drivers of rising premiums.

The underlying cost of Australia’s health system is the ailment; rising insurance premiums are just a symptom. Specifically, the fundamental forces pushing premiums up are higher claims costs experienced by insurers, through such factors as a greater uptake of medical services among policyholders and the rising cost of treatments and procedures. It is very much in the community’s interest that the current reform process continues, and private health insurers need to be an influential voice in that debate.

Thorough examination

Surviving and succeeding in this changing landscape requires resilience. The importance of resilience has been APRA’s consistent message to private health insurers over the past two and a half years, most starkly laid out in a speech last July by APRA’s senior manager of policy development, Peter Kohlhagen, to the Health Insurance Summit in Sydney (Kohlhagen 2017).

It is a message I seek to reinforce today. Whether cybersecurity, trust and reputation, affordability or policy and regulation, all financial institutions are exposed to risk — but not all are equally vulnerable.

Those entities with superior governance, business planning and risk management processes are better placed to adapt to change and overcome threats. It is entirely possible for smaller funds with fewer resources to be among this group, but in APRA’s experience, it is often institutions with lower levels of scale, access to resources and technical sophistication that find this most challenging.

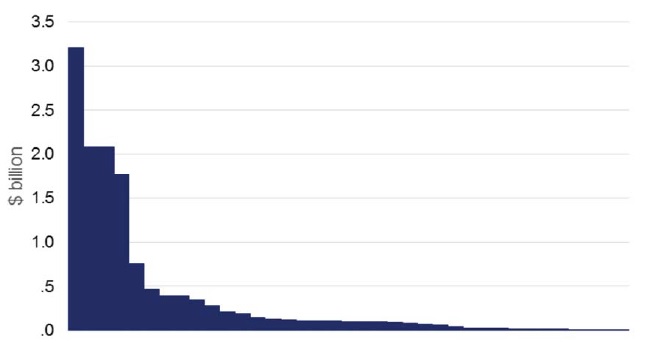

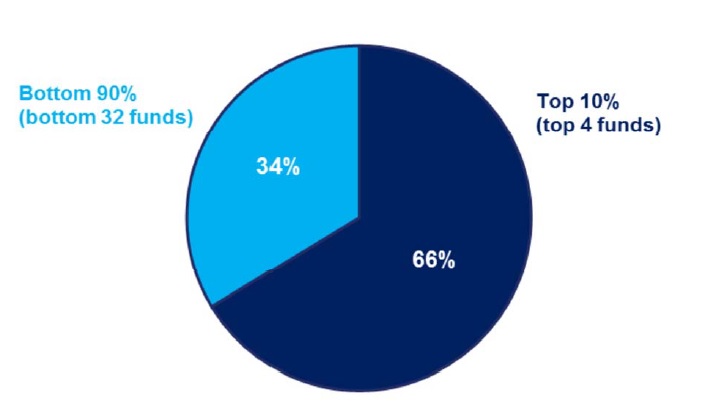

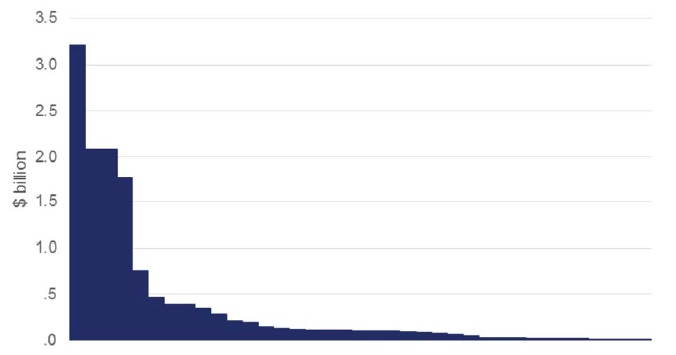

Figure 5: PHI total asset distribution (as at 30 June 2017)

Figure 5a: PHI total asset distribution (as at 30 June 2017)

In private health insurance, the largest four funds own 66% of the assets. The other 33 funds divide up the remaining third. A long industry tail is not necessarily a problem, nor should it be assumed that smaller health insurers are less viable and less competently run than larger insurers. In fact, many of the industry’s smaller players are performing well, but the data also raises a few red flags for APRA.

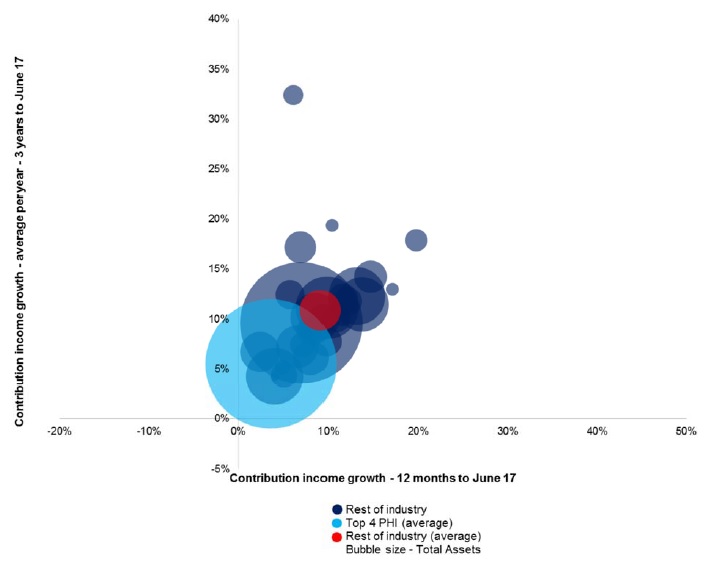

Figure 6: Comparisons of growth in contribution income (12 months to June 2017 versus average over three years to June 2017)

This table [Figure 6] shows all APRA-regulated private health insurers on the basis of premium income over both the 12 months to June last year and three years to the same point, excluding the four newest insurers. The blue bubble represents the largest four funds by total assets, and the red bubble is the average of the rest of the industry. We can see the smaller insurers have grown on average at a significantly faster rate in the past year than the top four, although there were outliers of all sizes.

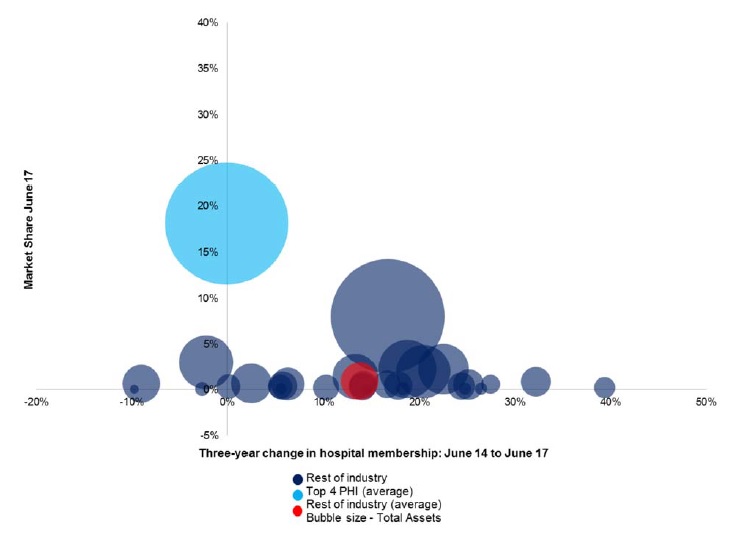

Figure 7: Analysis of membership growth (three-year change in hospital membership: June 2014 to June 2017)

Looking at membership growth in the three years to June 2017 and, as with premium income, the range is substantial, stretching from growth of almost 40% to falls of around 10%. But smaller funds (represented again by the red bubble) have, on average, quite dramatically outpaced the top four, which have been stagnant.

Threats to sustainability

From APRA’s perspective, these seemingly positive metrics for smaller health funds — growing membership and rising premium income — tell only a superficial story. Rapid growth in members can mean a rapid growth in risk, depending on how it has been cultivated. If insurers have lured new customers with low premiums or expanded benefits, they may face pressure on capital or cash flow if hit by a related spike in claims. If the market is rushing to exploit a vulnerability in a product that the insurer has failed to identify, it risks potentially major payouts that may threaten sustainability.

APRA expects boards to closely monitor the performance of all products, and seek to amend their business strategy if doubts emerge about their ability to cope with future claims. Conducting stress tests around benefit payments or scenario testing at an individual product level can help to gauge the likely impact of their company’s level of growth. Importantly, boards must act promptly and decisively where they identify prudential risks.

Prompt and decisive action is especially important in cases where boards diagnose sustainability concerns that may warrant merging with a stronger, but likeminded, partner. APRA believes mergers should be at least under active consideration by health insurers with low or negative member growth, and which only have small membership bases to begin with. Even boards with no such concerns about their fund’s viability should have discussed the issue of mergers as part of their normal strategic reviews. It is very much in their best interests to have thought about compatible future partners and how a merger might be structured well ahead of any need to put the plan into action — rather than being coerced into a marriage of inconvenience or forced to wind up.

It may be instructive here to look at another APRA-regulated industry with a long tail. The circumstances of superannuation and private health insurance are not identical, however the similarities in terms of industry structure are striking.

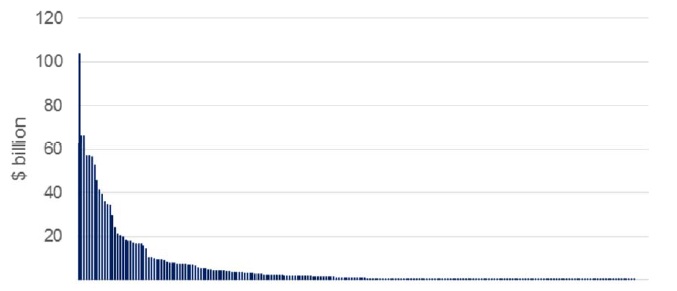

Figure 8: PHI total asset distribution (as at 30 June 2017)

Figure 9: Superannuation asset distribution (APRA-regulated funds, financial years ending in 2016)

Consolidation in superannuation system

In the APRA-regulated superannuation sector, 10% of funds manage 68% of total assets, compared to the 66 per cent of assets owned by the largest four private health insurers, representing roughly 10% of funds by number.

Speaking at a conference in November 2017, my APRA colleague Helen Rowell, noted that over the past five years the number of APRA-regulated super funds had contracted by 106, chiefly due to unsustainable funds closing or voluntarily choosing to merge (Rowell 2017). APRA has actively encouraged this to ensure members’ retirement savings aren’t left in underperforming funds.

We have yet to form a view on whether the consolidation we’ve seen in superannuation is necessary to protect policyholders’ interests in private health insurance. APRA has seen no evidence that smaller health insurers are, in general, providing worse cover or delivering poorer outcomes for their customers than bigger funds. But given the similarities with superannuation, we are undertaking a piece of work to consider whether similar issues are at play in health insurance. The review is examining a range of metrics to identify insurers that may have sustainability issues, and should provide some answers when it’s completed later this year.

Further treatment required

As the challenges facing health insurers evolve and grow, APRA continues to implement measures designed to keep the industry on a sustainable footing, guided by our policy roadmap and its three priorities: risk, governance and capital. Fundamentally, the proposals in the roadmap are about building resilient insurers.

Upon assuming prudential responsibility for private health insurance, APRA conducted a thematic risk review, which finished in May last year. This found that the industry was reasonably placed to meet our future requirements on risk management, but it did pinpoint some weaknesses: the formal use of risk management processes and data wasn’t widespread; we found few examples of regular and robust inquiry into how effectively risk management processes were operating; and there was generally poor integration of risk management into overall business management arrangements.

APRA has sought to address these issues primarily through the introduction from April this year of CPS 220 [Risk Management] (Australian Prudential Regulation Authority 2017), our cross-industry risk management prudential standard. CPS 220 sets out minimum expectations for how private health insurers must manage risk, and represents a higher bar than private health insurers have previously needed to clear. In time, we expect it will contribute to the establishment and maintenance of a strong risk management culture across private health insurers of all sizes, meaning prudential threats are more likely to be identified, assessed and acted upon in a timely manner.

APRA is now ready to advance Phase Two of the roadmap — governance. I’m pleased to announce that today we are releasing a discussion paper outlining proposed changes to the prudential framework for private health insurance. In the areas of governance, fit and proper requirements and audit requirements, APRA is seeking to introduce stronger cross-industry standards that have successfully lifted capabilities in other sectors we regulate.

Specifically, the package proposes replacing HPS 510 [Governance] standard with the more forceful cross-industry prudential standard CPS 510 [Governance] to drive improved industry practices. Cross-industry fit and proper standards will extend to private health insurance for the first time with the introduction of CPS 520 [Fit and Proper], and we are also proposing an audit prudential standard, recognising that private health insurance is the only APRA-regulated industry without such a measure.

By strengthening and refreshing governance practices among private health insurers, APRA expects to improve industry resilience by encouraging better decision-making, increasing the likelihood that emerging issues will be promptly identified and effectively managed.

A discussion paper will be released formally commencing our industry engagement process, and the full consultation package, including the draft standards and guides, will be available through the APRA website. Submissions are open for 12 weeks, and APRA will also be organising a series of roundtable discussions over the next few weeks as part of the consultation process.

Phase Three of the roadmap concerns capital standards, which provide a crucial financial buffer to help insurers remain comfortably solvent through the healthy and lean times. Capital standards were last reviewed and amended by the PHIAC in 2014, and APRA sees no pressing need for any modifications at this stage. However, our preliminary work on reviewing [the health insurance industry specific] prudential standards HPS 100 Solvency [Standard] and HPS 110 Capital Adequacy is likely to commence later this year.

Complementing the roadmap, stress testing is poised to become increasingly important over the next year in assessing insurers’ preparedness to handle current and emerging risks. In recent days, APRA sent a letter to all private health insurers requesting more information about the types and influence of the stress tests carried out as part of their risk and strategic management.

The responses will be collated, and will influence the design of APRA’s first industrywide stress tests, which we expect to conduct next financial year. This is a process we already conduct in other APRA-regulated financial sectors, and we see benefits in doing likewise in private health insurance. Health fund directors who want to get a sense of what to expect should consider reviewing how we’ve carried out stress tests in general or life insurance over recent years.

The patients’ responsibilities

While the responsibility of keeping private health insurance strong into the future falls partly on regulators and governments, it weighs far more heavily on the shoulders of the industry itself.

Boards have ultimate responsibility for the performance and viability of their companies, and their ongoing ability to fulfil commitments to policyholders. Our prudential framework, comprising legally binding standards and strongly recommended guidance, exists to help boards and senior managers put in place processes and structures that maximise their chances of remaining profitable and resilient. APRA’s supervisors proactively ask questions, probing and challenging entities, as well as giving guidance on industry best practice.

But our ability to assist you is weakened if we lack a complete picture of your business. It is strengthened when boards and management see their APRA supervisors, not as a threat, but as a valuable source of advice. Openness, transparency and honesty from private health insurers ensure we are both able to effectively perform our roles.

Avoid the temptation to spare us bad news as though we were poised to hand out penalties at the first sign of any concerns. Where APRA does identify sustainability issues among regulated entities, our initial response is to intensify supervisory support to help the entity return to a viable position. Resolution and enforcement actions only follow where entities are unable or unwilling to take the required steps to shore up their businesses.

Conclusion

APRA has no desire to see health funds that have served their communities for decades lose their unique identities through mergers, or possibly forced to wind up. However, as the inter-related challenges of affordability and adverse selection bite ever harder, APRA is looking closely for signs that insurers may breach prudential standards or become unsustainable. Our past experience across industries suggests smaller entities that lack the scale and resources of the multi-billion-dollar industry giants are often most at risk. If necessary, we will act decisively to protect beneficiaries and the industry as a whole from the harm a failure would cause, including by enforcing wind-ups or mergers.

It was once said that the future belongs to those who prepare for it today. By strengthening the prudential framework for private health insurance, APRA wants to ensure all insurers are adequately prepared for whatever challenges lie ahead. By complying with those standards, following the prudential guidance, and working cooperatively with APRA supervisors, insurers, no matter their size, put themselves in the best position to remain resilient and viable to enable them to serve their communities for many more generations to come.

References

Australian Bureau of Statistics 2017, “May key figures”, 17 August, Commonwealth of Australia, Canberra, viewed 8 February 2018 from <http://www.abs.gov.au/ausstats/abs@.nsf/mf/6302.0>.

Australian Prudential Regulation Authority (APRA) 2017, “APRA releases response paper on risk management consultation for private health insurers”, media release, 27 July, APRA, Sydney, viewed 8 January 2018 from <http://www.apra.gov.au/MediaReleases/Pages/17_26.aspx>.

Department of Health 2017, “Major reforms to make private health insurance simpler and more affordable”, media release, 13 October, minister for revenue and financial services the Hon. Greg Hunt MP, Commonwealth of Australia, Canberra, viewed 8 February 2018 from <http://www.health.gov.au/internet/ministers/publishing.nsf/Content/health-mediarel-yr2017-hunt106.htm>.

Kohlhagen, P 2017, Review of the private health insurance prudential framework: Building resilient insurers, 27 July, APRA, Sydney, viewed 8 February 2018 from <http://www.apra.gov.au/Speeches/Pages/Review-of-the-private-health-insurance-prudential-framework.aspx>.

Parliament of Australia 2017, Value and affordability of private health insurance and out-of-pocket medical costs, pp. ix–xii, 19 December, Commonwealth of Australia, Canberra, viewed 8 February 2018 from <https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Community_Affairs/Privatehealthinsurance/Report/b01>.

Rowell, H 2017, Enhancing Australia’s superannuation system: a vision for a sustainable future, 29 November, APRA, Sydney, viewed 8 February 2018 from <http://www.apra.gov.au/Speeches/Pages/Enhancing-Australias-superannuation-system.aspx>.